Loading... Please wait...

Loading... Please wait...- Home

- Guru

-

MEGA List

- MEGA List Page

- Categories

- All Brands

- Trading Books

- AdvancedGET

- MetaStock

- MetaStock Add-ons

- MetaStock Plug-Ins

- MetaStock Utilities

- MetaTrader

- MetaTrader EA

- MetaTrader EA (Forex)

- NinjaTrader

- Statistical Analysis

- TradeStation

- TradeStation Add-Ons

- Trading Software

- Betting Exchange Software

- Mega Page - New Stuff

- Personal Development Courses

- More MEGA LIST

- More Courses_

- Books

- More Books

- Mega List #1

- Mega List #2

- Mega List #3

- Real Estate

- Course by Category #1

- Course by Category #2

- Course by Author #1

- Course by Author #2

- Course by Author #3

- Course by Author #4

- RosettaStone

- Mega Page - 0

- Mega Page - A

- Mega Page - B

- Mega Page - C

- Mega Page - D

- Mega Page - E

- Mega Page - F

- Mega Page - G

- Mega Page - H

- Mega Page - I

- Mega Page - J

- Mega Page - K

- Mega Page - L

- Mega Page - M

- Mega Page - N

- Mega Page - O

- Mega Page - P

- Mega Page - Q

- Mega Page - R

- Mega Page - S

- Mega Page - T

- Mega Page - U

- Mega Page - V

- Mega Page - W

- Mega Page - X

- Mega Page - Y

- Mega Page - Z

- MEGA CATALOG

- Search MEGA CATALOG

- Entire 3TB Hard Drive for DayTraders - For Sale $3K

- Entire 4TB Hard Drive for DayTraders – For Sale $4K

- BigBoss Hard Drive for DayTraders – For Sale $3K

- MONEY Catalog

- Some More Courses

- dvd

- estore

- libr

- shop

- store

- Portfolio

- BigBoss Hard Drive for DayTraders

- Latest Database

- FAQ

- Info

-

Market Summary

- Corona Virus Stocks

- FREE IBD WEEKLY

- FREE STOCK CHARTS

- Market.Summary

- IBD 50

- DOW 30

- NASDAQ 100

- CNBC IQ 100

- IBD Sector Leaders

- IBD Stock Spotlight

- IBD Big Cap 20

- IBD CANSLIM Select

- IBD Global Leaders

- IBD IPO Leaders

- IBD New Highs

- IBD Rising Profit Estimates

- IBD Relative Strength At New High

- IBD Stocks That Big Mutual Funds Are Buying

- IBD Weekly Review

- IBD Stocks On The Move Up

- IBD Stocks On The Move Down

- Zacks Rank #1 Strong Buys

- Zacks Rank #5 Strong Sells

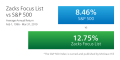

- Zacks Focus

- SPDR XLB Basic Materials

- SPDR XLC Communication Services

- SPDR XLE Energy

- SPDR XLF Financial

- SPDR XLI Industrials

- SPDR XLK Technology

- SPDR XLP Consumer Staples

- SPDR XLRE Real Estate

- SPDR XLU Utilities

- SPDR XLV Healthcare

- SPDR XLY Consumer Discretionary Goods

- Direxion Leveraged & Inverse ETFs

- IBD Innovator ETFs

- Technology ETFs

- Select Sector SPDR ETFs

- MARKET_SUMMARY

- 52 Week High Stocks

- 52 Week Low Stocks

- AGFiQ ETFs

- Airline Stocks

- Barron Stock Picks

- Bond ETFs

- IBD CANSLIM Grand Slam

- Casinos Gaming Stocks

- Commodity ETFs

- Equity ETFs

- ETF Investor

- First Trust ETFs

- Four Horsemen

- Home Run Investor

- IBD Breakout Opportunities ETF

- IBD Breakout Stocks

- IBD Dividend Leaders

- IBD ETF Leaders

- IBD Income Investor

- IBD REIT Leaders

- IBD Tech Leaders

- IBD Utility Leaders

- Income Investor

- International ETFs

- Invesco ETFs

- iShares ETFs

- JPMorgan ETFs

- Large Cap ETFs

- Marijuana Stocks

- Mid Cap ETFs

- ProShares ETFs

- REITs

- Sector ETFs

- Small Cap ETFs

- SPDR State Street Global Advisors ETFs

- Stocks at All Time Highs

- Stocks at All Time Lows

- Stocks Under $10

- Top 80 Technology ETFs

- Travel Hotel Stocks

- US Small Cap ETFs

- USAA ETFs

- Value Investor

- Warren Buffett Berkshire Hathaway Portfolio

- WisdomTree ETFs

- Zacks Top 10 Stocks

- Market Summary 2

- Publicly Traded Advertising and Marketing Stocks

- Publicly Traded Aerospace & Defense Stocks

- Publicly Traded Agricultural Stocks

- Publicly Traded Aviation Stocks

- Publicly Traded Biotech Stocks

- Publicly Traded Building Product and Materials Stocks

- Publicly Traded Business Service Stocks

- Publicly Traded Chemical Stocks

- Publicly Traded Clean Energy Stocks

- Publicly Traded Clothing and Footwear Stocks

- Publicly Traded Construction Stocks

- Publicly Traded Consumer Goods Stocks

- Publicly Traded Consumer Service Stocks

- Publicly Traded Cyber Security Stocks

- Publicly Traded Education and Training Stocks

- Publicly Traded Energy Stocks

- Publicly Traded Entertainment Stocks

- Publicly Traded Environmental Services Stocks

- Publicly Traded Financial Sector Stocks

- Publicly Traded Food and Beverage Stocks

- Publicly Traded Game and Hobby Stocks

- Publicly Traded Health and Fitness Stocks

- Publicly Traded Healthcare Facilities Stocks

- Publicly Traded Healthcare Stocks

- Publicly Traded Home Furnishing and Improvement Stocks

- Publicly Traded Industrial Stocks

- Publicly Traded Insurance Stocks

- Publicly Traded Internet Stocks

- Publicly Traded Materials Sector Stocks

- Publicly Traded Media Stocks

- Publicly Traded Medical Device and Equipment Stocks

- Publicly Traded Metal and Mining Stocks

- Publicly Traded Motor Vehicle Stocks

- Publicly Traded Multi Sector Stocks

- Publicly Traded Office Equipment and Supply Stocks

- Publicly Traded Pharmaceutical Stocks

- Publicly Traded Real Estate Stocks

- Publicly Traded Regional Major and Foreign Bank Stocks

- Publicly Traded REITs Stocks

- Publicly Traded Restaurants Stocks

- Publicly Traded Retail Stocks

- Publicly Traded Semiconductor Stocks

- Publicly Traded Shipping Stocks

- Publicly Traded Sin Stocks

- Publicly Traded Software Stocks

- Publicly Traded Sports Stocks

- Publicly Traded Technology Stocks

- Publicly Traded Telecommunications and Communications Stocks

- Publicly Traded Transportation Stocks

- Publicly Traded Travel and Tourism Stocks

- Publicly Traded Utilities Stocks

- SPDR Corporate & Government Bonds ETFs

- SPDR International ETFs

- Top 97 International Equity ETFs

- Portfolios

- Stock Charts

- MEGA VAULT

- Stream Movies

Categories

- Home

- MORE Courses

- XLT Options + Steve Nison - Candlestick Secrets For Profiting In Options

Product Description

1-STEVE NISON - CANDLESTICK SECRETS FOR PROFITING IN OPTIONS

[10 mp4, 31 pdf]

(1297 USD)

Candlestick Framework

Review of all the essentials you need to know about candlesticks so you are up to speed when Steve refers to them in the option strategy sections. In this module, the focus is the power of single candlestick lines.

Why Nison candlesticks and options are the perfect fit

The Trading Triad™

Doji essentials

Candles to set protective stops

The Hammer

The Shooting Star

The High Wave Candlestick

The Bullish Engulfing Pattern

The Bearish Engulfing Pattern

Rising and falling windows

Change of polarity

Snap and crack

Falling off the roof

Adapting to new market conditions

Chart challenges

Options Framework

If you are brand new to options this will get you quickly up to speed on the essentials. If you are an experienced option trader it is a great review and. PLUS, experienced options traders will pick up new approaches or ideas in this section.

The benefits of options

Review of option essentials

Buying In, At and Out of the Money Strikes

Implied Volatility

Out of the Money and In The Money – Pros/Cons of each

Time value decay

Advantages and disadvantages of short term expirations

Advantages and disadvantages of longer term expirations

The Greeks

Bull spread – definitions, best strikes, when to use, cautions

Bear spreads – definitions, best strikes, when to use, cautions

When to buy options outright instead of spreads

Methods to gauge confidence levels

Long outright option strategies for when you have high confidence

Long outright option strategies for when you have lower confidence

Finding the High Probability Option Strategies Using Nison Candlestick Strategies

Building on what you learned in the prior sessions, Steve now delves into specific option trading strategies using Nison candlesticks.

Importance of trend compared to implied volatility

Volatility skew

When to enter, exit and the best strike price to use for long calls

When to enter, exit and the best strike prices to use for long puts

When to enter, exit and best strike prices to use for bull debit spreads

When to enter, exit and best strike prices to use for bull credit spreads

When to enter, exit and best strike prices to use for bear debit spreads

When to enter, exit and best strike prices to use for bear credit spreads

Discover by using the Nison candlestick insights when to do an outright and when to do a spread

Advantages and cautions of bull debit and credit spreads

Advantages and cautions of bear debit and credit spreads

Using the brand new “Nison Candlestick Confidence Filtering Strategy ” to set up the perfect option trades

Secrets of Nison candlesticks for market direction and timing option trades

Using the Trading Triad Success System™ to help overcome option trading challenges

Why bearish candle signals must be traded differently in option markets

Nison Candlesticks for day trading options

Nison candlesticks for portfolio protection

When to use protective puts instead of covered calls

Nison candlestick timing strategies for covered calls

Nison candlestick timing strategies for protective puts

Using “Nison Candlestick Confirmation” for portfolio protection strategies

How to let your portfolio profits increase by knowing exactly when to exit a covered call or protective put

Chart Challenges and “Read Steve’s Mind”

SPECIAL BONUS SESSION: Using the Nison Candle Scanner software to quickly find a watch list of markets… plus our secret “Bouncing Ball” trading strategy

Merging Nison Candlesticks and Western indicators for High Success Option Strategies

Steve will reveal exactly how merging Nison candlesticks with Western indicators will be your one-two punch for option success.

Using the 4 New Nison Candlestick Confirmation Option Strategies™ for:

Long calls

Bull call spreads

Bull put spreads

Long puts

Bear put spreads

Bear call spreads

The one time you must use a credit spread instead of debit spread

The two simple questions you need to ask before you do any option trade

Improving success by setting up trades in the direction of major trend

Price target strategies for:

Long calls

Bull debit spreads

Bull credit spreads

Long puts

Bear debit spreads

Bear credit spreads

Option strategies using box ranges and Nison candlesticks

Option strategies using Bollinger Bands and Nison Candlesticks

The secret Nison Symmetry™ Strategy to forecast BOTH time and target

Option strategies using The Change of Polarity technique

Option strategies using The Falling Off the Roof technique

Option strategies using breakouts

Chart Challenges and “Read Steve’s Mind”

Trade Management Option Strategies for Improved Market Timing and Decreased Risk

A Japanese proverb states, “His potential is that of the fully drawn bow–his timing the release of the trigger” A correct understanding of Trade Management will tell you when, and when not to pull the trigger on an options trade:

Using Risk/Reward analysis to determine the correct option strategy

How options let you be more flexible with protective stops to help avoid being stopped out and then having the market go in your direction

Monitoring and adjusting open option positions

Using the “Market Chameleon” strategy to know when to leg into a bull spread

Using the “Market Chameleon” strategy to know when to leg into a bear spread

Rolling up on long calls to let profits ride during rallies

Rolling down on long puts to let profits ride during selloffs

Legging into bull and bear spreads to lock in profits

Low cost way to reverse positions by legging out of spreads

Using protective stops to protect trading capital

Using time stops to protect trading capital

Using the “Crack and Snap” strategy to leg out of a bull spread

Using the “Crack and Snap” strategy to leg out of a bear spread

Using Nison candlesticks to know when to exit open option trades

Chart Challenges and “Read Steve’s Mind”

2-XLT OPTIONS TRADING COURSE (ONLINE TRADING ACADEMY)

LEARN A TRADING STYLE THAT CAN STIMULATE YOUR INTELLECT, AS WELL AS YOUR WALLET.

An option is a contract to buy (=call) or sell (=put) an agreed-upon quantity of a specific stock or other asset at a specific price, up until a specific expiration date. Traders can write options on stocks they own, but you can also buy and sell options in the open market with no need to own the underlying stock.

Because the value of options is tied to price movement over a given period of time, options are far more volatile than stocks and price changes are dramatic; a $100 stock that goes to $110 has seen a 10% increase, but this might translate to a 100% increase in an option that allows you to buy at $100 anytime in the next six months. It’s not unreasonable that traders ask themselves, “Why should I spend $100 to buy a stock when I can control it with a $5 or $10 option?”

TWO TYPES OF OPTIONS TRADERS: DIRECTIONAL AND NON-DIRECTIONAL

There are two types of options traders, and we teach strategies for both of them in our Options Trader class. First is the directional trader, who uses technical analysis and market timing to predict whether the market is headed up or down, and then magnifies their bet by trading options vs. the underlying stocks.

Traders who believe the market is headed up can buy calls which allow them to buy a stock at a specific price, no matter how high the price may actually climb. Since this provides a no-risk opportunity to buy a stock and immediately sell it at a higher price, the option rises sharply in value if the stock goes up. Puts are for people who think the market is headed down; no matter how low a stock goes, they can sell it at the strike price according to the contract. Remember: there is no need to actually buy and take delivery of the stock. And, once the expiration date passes, the option is worthless.

Non-directional traders are interested in the net premium they retain after the sale of their options, rather than the price of individual options. A simple example is the straddle, which involves buying a put and a call on the same stock at the price with the same expiration date. Straddles are used when a trader expects dramatic movement but is not sure whether the movement will be up are down. If the stock goes up then the put becomes worthless, and the trader is left with the appreciation of the profit on the call, less the loss of the premium paid for the put.

HOW YOU CAN USE OPTIONS FOR RISK MANAGEMENT

The straddle, just described, is a high-risk strategy. But other options strategies are far more conservative and can be an important part of a trader’s capital-preservation toolkit. For example, if you own a stock and think its value might go down, you can hedge by selling a call option at today’s price. What you earn by writing the option partially offsets your potential loss. Or, if you want to buy a stock but feel it is overvalued at today’s price, you can effectively lower the price by selling a put which commits you to buy if it reaches your desired price. You make money from the put, whether or not you end up owning the stock.

ADVANCED OPTIONS TRADING TACTICS THAT PRODUCE A NON-LEVEL PLAYING FIELD.

In an efficient market, you’d expect that the price of options would get cheaper as the clock ticks toward their expiration date. And they do... but the process is not linear and that makes for some additional opportunities which in effect give savvy traders a non-level playing field. At Online Trading Academy, students learn how to buy puts and calls at the exact time that our supply and demand rules tell us they are cheap and about to become expensive.

Part of this calculation is an understanding of “The Greeks”—five different measurements of risk, each of them named after a different letter of the Greek alphabet: Delta, Theta, Gamma, Vega (not actually a Greek letter) and Rho. Online Trading Academy options students learn how to master these complex measurements as they build an options strategy which can meet any investment need—from capital preservation to dramatic upside potential in good markets or bad.

Many traders who become experts at options say they find it intellectually satisfying as well as profitable—like playing a great game of chess. Here is a way you can use your native intelligence in an enjoyable way that can also be very rewarding

Online Trading Academy - Extended Learning Track (XLT) - Options Trading

The XLT - Options Trading Course is the logical next step for serious student traders looking to master the trading skills needed to produce consistent profits from options trading and to continue their education beyond the Options Trader Part 1 and Part 2. This course builds on existing trading fundamentals and provides students with the knowledge and skills to create, manage and evolve various options strategies by observing an expert options trader operating in a live market arena using a mechanical approach to identify, assess and execute trading opportunities.

XLT - Options Trading curriculum is uniquely designed to fit with the monthly expiration cycle of a typical options trading calendar. This design allows our team of top options instructors, lead by Eric Ochotnicki, and their students the ability to leverage certain key times of the month to apply the learned concepts as well as identify optimal trading opportunities.

- Learn to identify, assess and execute Options trading opportunities

- Observe an Expert Options Instructor operating in a live market environment

- Learn practical applications that generate consistent profitability

XLT-Options-20090603 - Eric Ochotnicki - Non-Directional Trading.

XLT-Options-20090604 - Eric Ochotnicki - Position Building and JOBS report.

XLT-Options-20090605 - Eric Ochotnicki - Market Analysis.

XLT-Options-20090608 - Eric Ochotnicki - Position Building and Currency Options.

XLT-Options-20090610 - Eric Ochotnicki - Equivalency and Calendar Spreads.

XLT-Options-20090611 - Eric Ochotnicki - Expiration, New Options Cycle, Rolling and Closing.

XLT-Options-20090612 - Eric Ochotnicki - Position Building.

XLT-Options-20090617 - Eric Ochotnicki - Range Trading.

XLT-Options-20090618 - Eric Ochotnicki - Trading and Analysis.

XLT-Options-20090619 - Eric Ochotnicki - Expiration and Creating New Positions for the Next Cycle.

XLT-Options-20090701 - Eric Ochotnicki - Diagonal Spreads.

XLT-Options-20090702 - Eric Ochotnicki - Jobs Report and Postion Building.

XLT-Options-20090706 - Eric Ochotnicki - Position Building.

XLT-Options-20090708 - Eric Ochotnicki - Equivalency, Capital Usage and Calendar Spreads.

XLT-Options-20090709 - Eric Ochotnicki - Expiration, New Options Cycle, Rolling and Closing.

XLT-Options-20090710 - Eric Ochotnicki - Trading Opportunities - Building Positions - Portfolio Manage Mind Set.

XLT-Options-20090715 - Eric Ochotnicki - Swing Trading Related to Mean Reversion, Horizontal Trading.

XLT-Options-20090716 - Eric Ochotnicki - Rolling - Closing.

XLT-Options-20090717 - Eric Ochotnicki - Expiration.

XLT-Options-20090720 - Eric Ochotnicki - New Cycle Orientation.

XLT-Options-20090722 - Eric Ochotnicki - Volatility Analysis.

XLT-Options-20090723 - Eric Ochotnicki - Using the Checklist.

XLT-Options-20090724 - Eric Ochotnicki - Position Building.

XLT-Options-20090730 - Sam Seiden - Identifying Turning Points.

XLT-Options-20090805 - Eric Ochotnicki - Butterfly Toping and Ratio Spreads.

XLT-Options-20090806 - Eric Ochotnicki - Double Diagonals - Preparing for the Jobs Report.

XLT-Options-20090807 - Eric Ochotnicki - Jobs Report avi.

XLT-Options-20090810 - Eric Ochotnicki - Currencies - Commodities.

XLT-Options-20090812 - Eric Ochotnicki - Strategy Session Equivalency Calendar Spreads.

XLT-Options-20090813 - Eric Ochotnicki - Strategy Session Rolling - Closing.

XLT-Options-20090814 - Eric Ochotnicki - Trading Applications Position Building Butterflies - Ratios.

XLT-Options-20090819 - Eric Ochotnicki - Strategy Session Butterflies.

XLT-Options-20090820 - Eric Ochotnicki - Strategy Session Rolling - Closing.

XLT-Options-20090821 - Eric Ochotnicki - Trading Application Expiration.

XLT-Options-20090824 - Eric Ochotnicki - New Cycle Orientation.

XLT-Options-20090826 - Eric Ochotnicki - Strategy Session Volatility Analysis.

XLT-Options-20090827 - Eric Ochotnicki - Strategy Session Using the Checklist.

XLT-Options-20090828 - Eric Ochotnicki - Trading Applications Position Building.

XLT-Options-20090902 - Eric Ochotnicki - Strategy Session Stock Placement.

XLT-Options-20090903 - Eric Ochotnicki - Strategy Session - Double Diagonals - Preparing For the Jobs Report.

XLT-Options-20090904 - Eric Ochotnicki - Trading Application - Jobs Report.

XLT-Options-20090909 - Eric Ochotnicki - Strategy Session - Equivalency Calendar Spreads.

XLT-Options-20090910 - Eric Ochotnicki - Strategy Session - Rolling and Closing.

XLT-Options-20090911 - Eric Ochotnicki - Trading Application - Position Building.

XLT-Options-20090916 - Eric Ochotnicki - Strategy Session - Macro Trading.

XLT-Options-20090917 - Eric Ochotnicki - Strategy Session - Rolling and Closing.

XLT-Options-20090918 - Eric Ochotnicki - Trading Application - Expiration.

XLT-Options-20090921 - Eric Ochotnicki - New Cycle Orientation.

XLT-Options-20090923 - Eric Ochotnicki - Strategy Session - Traders Checklist.

XLT-Options-20090924 - Eric Ochotnicki - Strategy Session - Traders Checklist.

XLT-Options-20090925 - Eric Ochotnicki - Strategy Session - Position Building.

XLT-Options-20091001 - Eric Ochotnicki - Strategy Session - Double Diagonals and Preparing for the Jobs Report.avi

XLT-Options-20091002 - Eric Ochotnicki - Trading Application - Jobs Report.

XLT-Options-20091005 - Eric Ochotnicki - Strategy Session - Commodities.

XLT-Options-20091007 - Eric Ochotnicki - Strategy Session - Equivalency Calendar Spreads.

XLT-Options-20091008 - Eric Ochotnicki - Strategy Session - Rolling and Closing.

XLT-Options-20091009 - Eric Ochotnicki - Trading Application - Position Building.

XLT-Options-20091015 - Eric Ochotnicki - Strategy Session - Position Evolution Presented.

XLT-Options-20091016 - Eric Ochotnicki - Trading Application - Expiration.

XLT-Options-20091019 - Eric Ochotnicki - New Cycle Orientation.

XLT-Options-20091021 - Eric Ochotnicki - Strategy Session - Volatility Analysis.

XLT-Options-20091022 - Eric Ochotnicki - Strategy Session - Traders Checklist.

XLT-Options-20091023 - Eric Ochotnicki - Trading Application - Position Building.

XLT-Options-20091028 - Eric Ochotnicki - Strategy Session - Macro Trading.

XLT-Options-20091029 - Eric Ochotnicki - Strategy Session - Deal'n with Dividends.

XLT-Options-20091104 - Eric Ochotnicki - Strategy Session - Options for Income.

XLT-Options-20091105 - Eric Ochotnicki - Strategy Session - Double Diagonals & Preparing for the Jobs Report.

XLT-Options-20091106 - Eric Ochotnicki - Trading Application - Jobs Report.

XLT-Options-20091109 - Eric Ochotnicki - Strategy Session - Commodities.

XLT-Options-20091111 - Eric Ochotnicki - Strategy Session - Equivalency Calendar Spreads.

XLT-Options-20091112 - Eric Ochotnicki - Strategy Session - Rolling and Closing.

XLT-Options-20091113 - Eric Ochotnicki - Trading Application - Position Building.

XLT-Options-20091116 - Eric Ochotnicki - Strategy Session - Stock Replacement.

XLT-Options-20091118 - Eric Ochotnicki - Strategy Session - Macro Trading.

XLT-Options-20091119 - Eric Ochotnicki - Strategy Session - Position Evolution.

XLT-Options-20091120 - Eric Ochotnicki - Trading Application - Expiration.

XLT-Options-20091123 - Eric Ochotnicki - New Cycle Orientation.

XLT-Options-20091125 - Eric Ochotnicki - Strategy Session - Volatility Analysis.

XLT-Options-20091130 - Eric Ochotnicki - Strategy Session - Traders Checklist.

XLT-Options-20091202 - Eric Ochotnicki - Strategy Session - Position Construction.

XLT-Options-20091203 - Eric Ochotnicki - Strategy Session - Student Position Review - Preparing for the Jobs Report.

XLT-Options-20091204 - Eric Ochotnicki - Trading Application - Jobs Report.

XLT-Options-20091207 - Eric Ochotnicki - Strategy Session - Options for Income - Part Time Trader.

XLT-Options-20091209 - Eric Ochotnicki - Strategy Session - Stock Replacement.

XLT-Options-20091210 - Eric Ochotnicki - Strategy Session - Rolling and Closing.

XLT-Options-20091211 - Eric Ochotnicki - Strategy Session - Position Building.

XLT-Options-20091216 - Eric Ochotnicki - Strategy Session - Macro Trading.

XLT-Options-20091217 - Eric Ochotnicki - Strategy Session - Vega Trading.

XLT-Options-20091218 - Eric Ochotnicki - Trading Application - Expiration.

XLT-Options-20091221 - Eric Ochotnicki - Strategy Session - Volatility Analysis.

XLT-Options-20091222 - Eric Ochotnicki - Strategy Session - Traders Checklist.

XLT-Options-20091223 - Eric Ochotnicki - Strategy Session - Position Building.

XLT-Options-20091228 - Eric Ochotnicki - Strategy Session - Student Position Review.