Loading... Please wait...

Loading... Please wait...- Home

- Guru

-

MEGA List

- MEGA List Page

- Categories

- All Brands

- Trading Books

- AdvancedGET

- MetaStock

- MetaStock Add-ons

- MetaStock Plug-Ins

- MetaStock Utilities

- MetaTrader

- MetaTrader EA

- MetaTrader EA (Forex)

- NinjaTrader

- Statistical Analysis

- TradeStation

- TradeStation Add-Ons

- Trading Software

- Betting Exchange Software

- Mega Page - New Stuff

- Personal Development Courses

- More MEGA LIST

- More Courses_

- Books

- More Books

- Mega List #1

- Mega List #2

- Mega List #3

- Real Estate

- Course by Category #1

- Course by Category #2

- Course by Author #1

- Course by Author #2

- Course by Author #3

- Course by Author #4

- RosettaStone

- Mega Page - 0

- Mega Page - A

- Mega Page - B

- Mega Page - C

- Mega Page - D

- Mega Page - E

- Mega Page - F

- Mega Page - G

- Mega Page - H

- Mega Page - I

- Mega Page - J

- Mega Page - K

- Mega Page - L

- Mega Page - M

- Mega Page - N

- Mega Page - O

- Mega Page - P

- Mega Page - Q

- Mega Page - R

- Mega Page - S

- Mega Page - T

- Mega Page - U

- Mega Page - V

- Mega Page - W

- Mega Page - X

- Mega Page - Y

- Mega Page - Z

- MEGA CATALOG

- Search MEGA CATALOG

- Entire 3TB Hard Drive for DayTraders - For Sale $3K

- Entire 4TB Hard Drive for DayTraders – For Sale $4K

- BigBoss Hard Drive for DayTraders – For Sale $3K

- MONEY Catalog

- Some More Courses

- dvd

- estore

- libr

- shop

- store

- Portfolio

- BigBoss Hard Drive for DayTraders

- Latest Database

- FAQ

- Info

-

Market Summary

- Corona Virus Stocks

- FREE IBD WEEKLY

- FREE STOCK CHARTS

- Market.Summary

- IBD 50

- DOW 30

- NASDAQ 100

- CNBC IQ 100

- IBD Sector Leaders

- IBD Stock Spotlight

- IBD Big Cap 20

- IBD CANSLIM Select

- IBD Global Leaders

- IBD IPO Leaders

- IBD New Highs

- IBD Rising Profit Estimates

- IBD Relative Strength At New High

- IBD Stocks That Big Mutual Funds Are Buying

- IBD Weekly Review

- IBD Stocks On The Move Up

- IBD Stocks On The Move Down

- Zacks Rank #1 Strong Buys

- Zacks Rank #5 Strong Sells

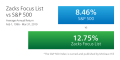

- Zacks Focus

- SPDR XLB Basic Materials

- SPDR XLC Communication Services

- SPDR XLE Energy

- SPDR XLF Financial

- SPDR XLI Industrials

- SPDR XLK Technology

- SPDR XLP Consumer Staples

- SPDR XLRE Real Estate

- SPDR XLU Utilities

- SPDR XLV Healthcare

- SPDR XLY Consumer Discretionary Goods

- Direxion Leveraged & Inverse ETFs

- IBD Innovator ETFs

- Technology ETFs

- Select Sector SPDR ETFs

- MARKET_SUMMARY

- 52 Week High Stocks

- 52 Week Low Stocks

- AGFiQ ETFs

- Airline Stocks

- Barron Stock Picks

- Bond ETFs

- IBD CANSLIM Grand Slam

- Casinos Gaming Stocks

- Commodity ETFs

- Equity ETFs

- ETF Investor

- First Trust ETFs

- Four Horsemen

- Home Run Investor

- IBD Breakout Opportunities ETF

- IBD Breakout Stocks

- IBD Dividend Leaders

- IBD ETF Leaders

- IBD Income Investor

- IBD REIT Leaders

- IBD Tech Leaders

- IBD Utility Leaders

- Income Investor

- International ETFs

- Invesco ETFs

- iShares ETFs

- JPMorgan ETFs

- Large Cap ETFs

- Marijuana Stocks

- Mid Cap ETFs

- ProShares ETFs

- REITs

- Sector ETFs

- Small Cap ETFs

- SPDR State Street Global Advisors ETFs

- Stocks at All Time Highs

- Stocks at All Time Lows

- Stocks Under $10

- Top 80 Technology ETFs

- Travel Hotel Stocks

- US Small Cap ETFs

- USAA ETFs

- Value Investor

- Warren Buffett Berkshire Hathaway Portfolio

- WisdomTree ETFs

- Zacks Top 10 Stocks

- Market Summary 2

- Publicly Traded Advertising and Marketing Stocks

- Publicly Traded Aerospace & Defense Stocks

- Publicly Traded Agricultural Stocks

- Publicly Traded Aviation Stocks

- Publicly Traded Biotech Stocks

- Publicly Traded Building Product and Materials Stocks

- Publicly Traded Business Service Stocks

- Publicly Traded Chemical Stocks

- Publicly Traded Clean Energy Stocks

- Publicly Traded Clothing and Footwear Stocks

- Publicly Traded Construction Stocks

- Publicly Traded Consumer Goods Stocks

- Publicly Traded Consumer Service Stocks

- Publicly Traded Cyber Security Stocks

- Publicly Traded Education and Training Stocks

- Publicly Traded Energy Stocks

- Publicly Traded Entertainment Stocks

- Publicly Traded Environmental Services Stocks

- Publicly Traded Financial Sector Stocks

- Publicly Traded Food and Beverage Stocks

- Publicly Traded Game and Hobby Stocks

- Publicly Traded Health and Fitness Stocks

- Publicly Traded Healthcare Facilities Stocks

- Publicly Traded Healthcare Stocks

- Publicly Traded Home Furnishing and Improvement Stocks

- Publicly Traded Industrial Stocks

- Publicly Traded Insurance Stocks

- Publicly Traded Internet Stocks

- Publicly Traded Materials Sector Stocks

- Publicly Traded Media Stocks

- Publicly Traded Medical Device and Equipment Stocks

- Publicly Traded Metal and Mining Stocks

- Publicly Traded Motor Vehicle Stocks

- Publicly Traded Multi Sector Stocks

- Publicly Traded Office Equipment and Supply Stocks

- Publicly Traded Pharmaceutical Stocks

- Publicly Traded Real Estate Stocks

- Publicly Traded Regional Major and Foreign Bank Stocks

- Publicly Traded REITs Stocks

- Publicly Traded Restaurants Stocks

- Publicly Traded Retail Stocks

- Publicly Traded Semiconductor Stocks

- Publicly Traded Shipping Stocks

- Publicly Traded Sin Stocks

- Publicly Traded Software Stocks

- Publicly Traded Sports Stocks

- Publicly Traded Technology Stocks

- Publicly Traded Telecommunications and Communications Stocks

- Publicly Traded Transportation Stocks

- Publicly Traded Travel and Tourism Stocks

- Publicly Traded Utilities Stocks

- SPDR Corporate & Government Bonds ETFs

- SPDR International ETFs

- Top 97 International Equity ETFs

- Portfolios

- Stock Charts

- MEGA VAULT

- Stream Movies

Categories

- Home

- Bonus Items

- Special Bundle Pack 02

Product Description

Broken Wing Butterfly Master Track Series

+

THE TEA IRON CONDOR SYSTEM (SMB CAPITAL)

+

Jeff Augen Short Butterfly Course

1-)BROKEN WING BUTTERFLY MASTER TRACK SERIES

Anyone can follow a trade.

That doesn’t make you a great trader, all it does is prove you can continue to let someone else control your financial future, your destiny.

At Locke In Your Success our goal is to teach you to make intelligent decisions for yourself.

Take control of your future with The Broken Wing Butterfly Master Track Series.

During this track series, John Locke will show how to profitably trade Broken Wing Butterfly (BWB) profile positions on the SPX, RUT and NDX. The track series will start at a basic level from the very beginning and progress through to the advanced concepts behind the broken wing butterfly profile trade. This track does not teach a specific strategy but will cover the concepts behind all the popular broken wing butterfly profile trades including how to pick the proper entries and the best upside and downside adjustment strategies for specific market conditions.

“It’s not about discipline, and it’s not about robotically following setups that someone has taught you. It’s about understanding how markets work and defining strategies that exploit that understanding.” – Brett Steenbarger, Trading Psychology 2.0: From Best Practices to Best Processes (Wiley Trading)

The prerequisite to this track is to have a basic level of knowledge of options spreads, which means:

◦You know what an unbalanced or broken wing butterfly is

◦You have some experience trading options spreads

◦You have a basic understanding of the Greeks (Delta, Theta, Gamma Vega)

◦You know how to use analytical software such as OptionVue or OptionNetExplorer

◦You are familiar with the basic terminology of options spread trading like vertical spreads, condors, wings, T+0 line, expiration line and days till expiration (DTE)

The track includes four classes with over six hours of instruction on:

Trade Entries

Days to expiration (DTE) – Close vs far from expiration and how DTE changes the trade

Choosing wing widths

Broken Wing Butterfly vs Butterfly/call entry

Entry location relative to at the money (ATM) and how your entry effects your adjustment strategy

Scaling entries/adjustment strategies

Upside adjustments strategies

Adapting your upside adjustment strategy to:

Different volatility levels

Rising markets

Falling markets

Sideways markets

Downside adjustment strategies – The “Achilles’ Heel” for most traders

How and when to best adjust to the downside for maximum protection with least whipsaw risk

How to set risk parameters

Planned Capital

Profit Target

Max Loss

Trade Exits

When and how to exit most effectively

2-)THE TEA IRON CONDOR SYSTEM

Sale page : smbcapital

The 100% systematic way for option traders to manage iron condor spreads to proactively reduce risk and increase reliability.

In “The TEA Iron Condor”, Andrew Falde shows you:

How using a technical signal can help you proactively reduce risk in market neutral trades and reduce the subjectivity in your trading.

The exact rules of the strategy which can be applied to accounts from $10,000 and up.

Tons of day-by-day examples so you are confident that you will know how to make the right adjustments at the right time.

How a proper management strategy can dramatically improve your probabilities of success over time

divider

How Can a 100% Systematic Trade Produce Consisent Results?

Multiple Management Methods in One System: The TEA Iron Condor covers the major aspects of trading in one program. You will benefit from managing the trend, momentum, and range all with one set of rules.

The Momentum/Trend: This is managed through the signal, sizing of each side of the iron condor, and the adjustment of strike placement through the trade.

Premium Decay: This trade primarily benefits from premium decay (Positive Theta) in options. The directional components of the systems are designed to not interfere with premium decay, but rather to defend it.

Range: When the market sits in a range, this trade performs great… but unlike many iron condor strategies, this trade can do very well in bullish and bearish trends as well.

2-)JEFF AUGEN SHORT BUTTERFLY COURSE

SMB is recognized for teaching new and semi-experienced traders how to profitably trade equities. SMB was founded by two well-educated, experienced, and active traders, who have collectively traded for 25 plus years. During these years we have learned and utilized different trading styles to become well-rounded, self-directed, consistently profitable traders.

A few years ago we realized that the market was harder to navigate than when we began. It was more difficult for a new trader to become profitable without advanced training and mentoring from professional traders. And thus there was need for a training program and trader mentoring that considered these changes. SMB created a world class training program so that new traders are given the best chance to succeed. And now all the training that we offer our professional proprietary traders is offered to you.

SMB’s Options Tribe is an online community of options traders dedicated to sharing successful options trading ideas with all of our members worldwide. Each week the community will meet online for the primary purpose of watching live presentations made by veteran options traders and experts in the world of options trading.

On August 20 renowned options educator Jeffrey Augen introduced the Weekly Short Butterfly Trade Video series that he produced for the SMBU Options Strategy Series.

3-) JEFF AUGEN SHORT BUTTERFLY COURSE